Pre tax income calculator

Subtracting cost of goods sold from sales revenue gives you a gross profit of 100000. For example pre-tax deductions for retirement investment.

What Are Marriage Penalties And Bonuses Tax Policy Center

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

. Provides insight into a companys financial standing. 100 Accurate Calculations Guaranteed. Net Income Earnings Before Taxes 1-Effective Tax Rate With a little of arithmetic we get.

ABC Ltd prepares its income statement for the year ended 2018-19. Earnings Before Taxes Net Income 1-Effective Tax Rate Now back to. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Pre Tax Income Calculator. In the second field input how many hours you. It can also be used to help fill steps 3 and 4 of a W-4 form.

Estimate your US federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas. Calculate the employees gross wages. Then determine how much you were paid during that pay cycle.

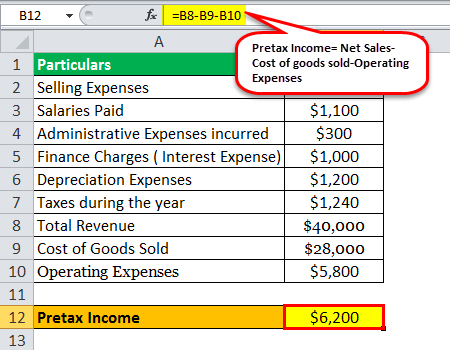

EBT is the penultimate item in the Income statement before adjustment of taxes is undertaken. The pre-tax profit margin can be calculated by dividing the EBT by revenue. Pre-tax income often known as gross income is your total income before you pay income taxes but after deductions.

Examples of Pre Tax Income. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and. Net Income - Please enter the amount of Take Home Pay you require.

Taxes affect the overall earnings of a company. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. Enter your info to see your take home pay.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. After salary sacrifice before tax Employment income frequency Other taxable income. Use the pre tax income calculator to calculate the pretax income for your financial problems.

Pre-Tax Margin 25 million 100 million 25. From there the final step before arriving at net income is to. Enter the hourly wage - how much money you earn per hour.

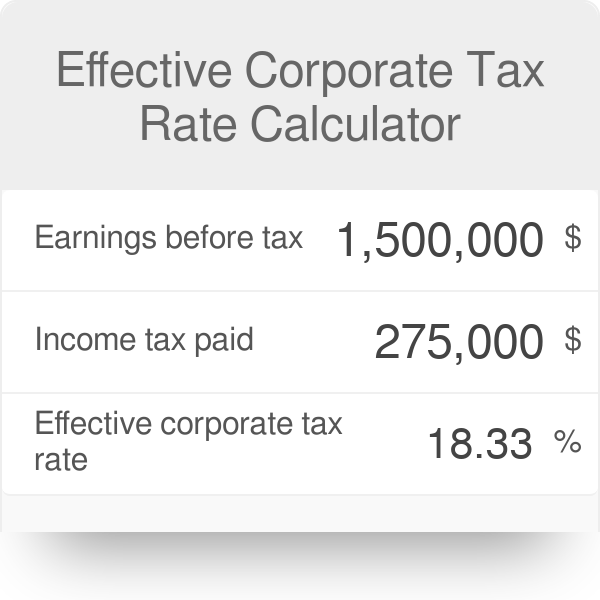

We can compute it using various methods. To calculate your annual income before taxes obtain a copy of your most recent paycheck. Effective tax rate 172.

Examples of pre tax income are given below. Of course taxes will be due when you withdraw money from your Plan. Divide Saras annual salary by the number of times shes paid during the year.

Her gross pay for the period is 2000 48000 annual. Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Ad Try Our Free And Simple Tax Refund Calculator.

Some of the popular formulas for the calculation of. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Other taxable income frequency Annually Monthly Fortnightly Weekly Financial.

The calculator will calculate tax on your taxable income only. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. This is the NET amount after Tax the.

Subtracting SGA gives you 40000 in EBIT or earnings before interest and taxes. Pretax earnings hence provide an. You calculate the pre-tax earnings by subtracting operating and interest expenses from your gross profit.

That means that your net pay will be 43041 per year or 3587 per month. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Tax Year - Select the Tax Year to calculate tax years start 6th April and end 5th April.

How to calculate Federal Tax based on your Annual Income. 50000 30000 20000. Prior to any deductions Itemized Deductions.

It can be used for the. Significance of Pretax Income. 401 k 403 b 457 plans.

How Income Taxes Are Calculated. Discover Helpful Information And Resources On Taxes From AARP. For example if you made 30000 last year and put 3000 in your retirement plan account on a pre-tax basis your.

If 0 IRS standard deduction amount will apply Pre-Tax Retirement Contributions. This is how to calculate your annual income with our calculator. A pay period can be weekly fortnightly or monthly.

Income Percentile Calculator For The United States

Pretax Income Definition Formula And Example Significance

Ebit Formula And Operating Income Calculator Excel Template

How To Calculate Tax On Salary Factory Sale 56 Off Www Ingeniovirtual Com

Net Operating Profit After Tax Nopat Formula And Calculator Excel Template

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

Paycheck Calculator Take Home Pay Calculator

Annual Income Calculator

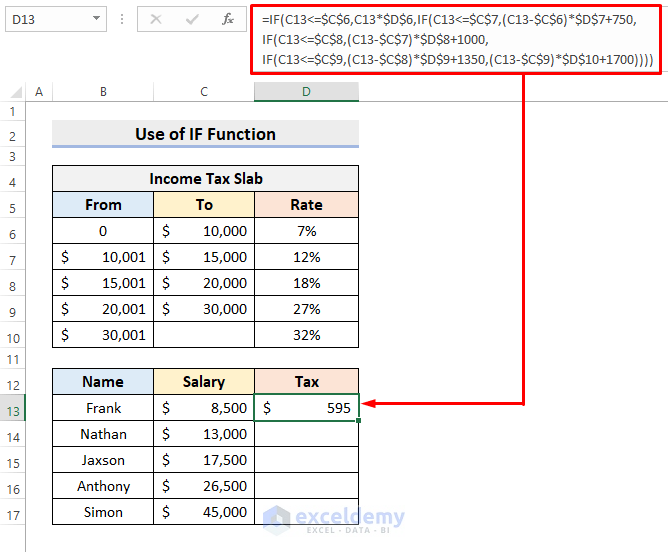

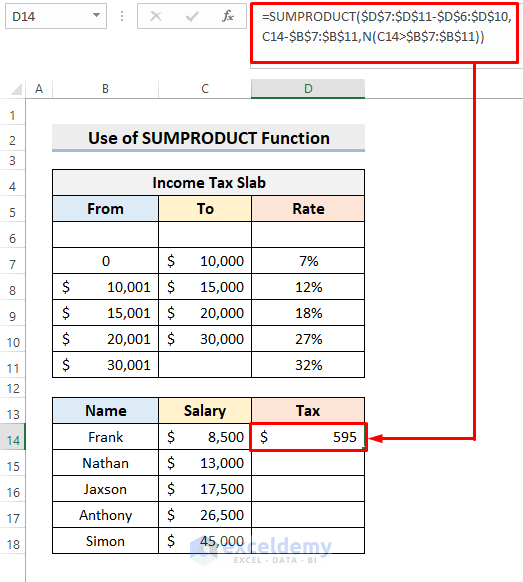

How To Calculate Income Tax In Excel Using If Function With Easy Steps

How To Calculate Income Tax In Excel Using If Function With Easy Steps

Effective Corporate Tax Rate Calculator

How To Calculate Gross Income Per Month

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Pre Tax Income Ebt Formula And Calculator Excel Template

Excel Formula Income Tax Bracket Calculation Exceljet